Contents:

CIM’s EV/EBIT ratio has moved up 300.8 over the prior 185 months. If you’re looking for stocks that are quantitatively similar to CHIMERA INVESTMENT CORP, a group of peers worth examining would be BBDC, NAVI, BLX, WHF, and LFT. The strongest trend for CIM is in Growth, which has been heading up over the past 177 days. One share of Chimera Investment Corporation is valued at 5,46 $.

Brokerage services for alternative assets available on Public are offered by Dalmore Group, LLC (“Dalmore”), member of FINRA & SIPC. “Alternative assets,” as the term is used at Public, are equity securities that have been issued pursuant to Regulation A of the Securities Act of (“Regulation A”). These investments are speculative, involve substantial risks , and are not FDIC or SIPC insured.

Industry

NEW YORK—-The Board of Directors of Chimera announced the declaration of its third quarter cash dividend of $0.23 per share of common stock. Or is there an opportunity to expand the business’ product line in the future? Factors like these will boost the valuation of Chimera Investment.

P/B Ratios below 1 indicate that a company could be undervalued with respect to its assets and liabilities. The P/E ratio of Chimera Investment is -2.18, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings. Only 0.47% of the stock of Chimera Investment is held by insiders. Only 7 people have added Chimera Investment to their MarketBeat watchlist in the last 30 days. 45 people have searched for CIM on MarketBeat in the last 30 days. Chimera Investment does not have a long track record of dividend growth.

What Are Clean Energy ETFs And Should You Invest In Them?

Below are the latest news stories about CHIMERA INVESTMENT CORP that investors may wish to consider to help them evaluate CIM as an investment opportunity. The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.CIM has a Quality Grade of B, ranking ahead of 83.94% of graded US stocks. Over the past 70 months, CIM’s revenue has gone down $1,183,050,000.The table below shows CIM’s growth in key financial areas . The ratio of debt to operating expenses for CHIMERA INVESTMENT CORP is higher than it is for about 99.01% of US stocks. CIM scores best on the Growth dimension, with a Growth rank ahead of 92.23% of US stocks.

- Factors like these will boost the valuation of Chimera Investment.

- However, volatility can also present opportunities for investors to make gains by buying stocks when prices are low and selling when they are high.

- The monthly returns are then compounded to arrive at the annual return.

- All values as of most recently reported quarter unless otherwise noted.

- The current trade recommendation is based on an ongoing consensus estimate among financial analysts covering Chimera Investment.

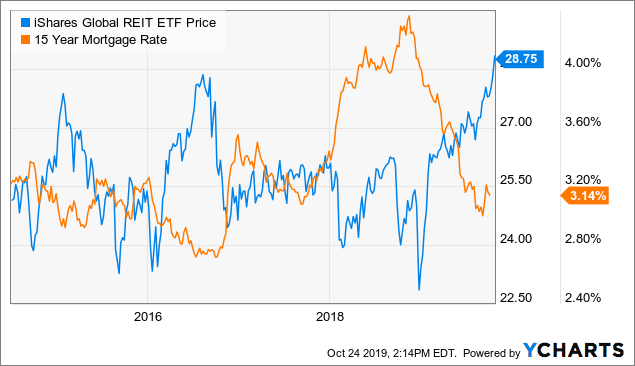

Market Cap is calculated by multiplying the number of shares outstanding by the stock’s price. To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company’s dividend expressed as a percentage of its current stock price. Chimera Investment best dividend stocks to invest in for 2021 Corporation is a publicly traded real estate investment trust, or REIT, that is primarily engaged in real estate finance. It invests, either directly or indirectly through its subsidiaries, in RMBS, residential mortgage loans, Agency CMBS, commercial mortgage loans, real estate-related… Income is generated by the net spread between the income earned on investments and the costs of financing.

CHIMERA INVESTMENT CORPORATION REPORTS 4TH QUARTER 2022 EARNINGS

Chimera Investment’s investment highlights are automatically generated signals that are significant enough to either complement your investing judgment regarding Chimera Investment or challenge it. These highlights can help you better understand the position you are entering and avoid costly mistakes. The value of investments can go up as well as down and you may receive back less than your original investment. As all investments carry risk, before making any investment decision, consider if it’s right for you and seek appropriate advice from a licensed tax or financial advisor. Past performance is not a reliable indication of future performance. No representation is made as to the timeliness, reliability, accuracy or completeness of the market data provided.

To see all exchange delays and terms of use please see Barchart’s disclaimer. The company is scheduled to release its next quarterly earnings announcement on Thursday, May 4th 2023. Chimera Investment’s stock was trading at $5.50 at the beginning of 2023. Since then, CIM stock has decreased by 2.0% and is now trading at $5.39. 47.06% of the stock of Chimera Investment is held by institutions. High institutional ownership can be a signal of strong market trust in this company.

Chimera Investment has about 264.6M in cash with 325.72M of positive cash flow from operations. SectorIndustryMarket CapRevenue FinanceREIT – Mortgage Trusts$1.252B$0.773B Chimera Investment Corporation is a publicly traded real estate investment trust, or REIT, that is primarily engaged in real estate finance. It invests, either directly or indirectly through its subsidiaries, in RMBS, residential mortgage loans, Agency CMBS, commercial mortgage loans, real estate-related securities and various other asset classes. The company has elected and is organized and has operated in a manner that enables it to be taxed as a REIT under the Internal Revenue Code.

Profitability Rank

NEW YORK—-The Board of Directors of Chimera announced the declaration of its fourth quarter cash dividend of $0.23 per share of common stock. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals. Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward trend or a buy.

Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. Chimera Investment Corporation is a specialty finance company that invests in residential mortgage backed securities or RMBS residential mortgage loans real estate-related securities and various other asset classes. Chimera Investment Corporation invests in residential mortgage loans, residential mortgage-backed securities, real estate-related securities and various other asset classes. The company was founded in 2007 and is based in New York, New York.

Chimera Investment’s market cap is calculated by multiplying CIM’s current stock price of $5.39 by CIM’s total outstanding shares of 231,826,520. Chimere Investment Corporation is based in New York, New York, trades on the New York Stock Exchange, and works to provide attractive risk-adjusted returns via dividends and capital preservation. As of late 2022, the company had more than $3 billion in capitalization including common and preferred stock, and had paid more than $5.8 billion in dividends. Intraday Data provided by FACTSET and subject to terms of use. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only.

Be the first to know about important CIM news, forecast changes, insider trades & much more!Get Free CIM Updates

NEW YORK—-The Board of Directors of Chimera announced the declaration of its fourth quarter cash dividend of $0.50 per share of 8% Series A Cumulative Redeemable Preferred Stock. The Board of Directors of Chimera announced the declaration of its fourth quarter cash dividend of $0.50 per share of 8% Series A Cumulative Redeemable Preferred Stock. Price action analysis of ChimeraInvestment based on a short term time period is definitely negative. This means that there is a strong downtrend in the stock for given time period.

Why is CIM dividend so high?

The dividend yield, even after the cut, is high because the stock has fallen so much this year, with a 58% decline. These losses were mainly mark-to-market losses, so if mortgage-backed securities rebound relative to Treasuries, they could be recouped.

However, as a general rule, conservative investors tend to hold large-cap stocks, and those looking for more risk prefer small-cap and mid-cap equities. Chimera Investment runs under Mortgage Real https://day-trading.info/ Estate Investment Trusts sector within Financials industry. The entity has 231.83M outstanding shares of which 9.2M shares are currently shorted by investors with about 5.53 days to cover.

News

However, Chimera Investment’s price is the amount at which it trades on the open market and represents the number that a seller and buyer find agreeable to each party. The current trade recommendation is based on an ongoing consensus estimate among financial analysts covering Chimera Investment. The Chimera consensus assessment is calculated by taking the average forecast from all of the analysts covering Chimera Investment.

Is CIM a good dividend stock?

Yes, CIM has paid a dividend within the past 12 months. How much is Chimera Investment's dividend? CIM pays a dividend of $0.23 per share. CIM's annual dividend yield is 15.48%.

Chimera Investment has only been the subject of 2 research reports in the past 90 days. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. There are many who think that following the filings of billionaire hedge fund managers and investors is a great way to build a portfolio, but there are a number of reasons why this thinking is flawed. Tomorrow’s movement Prediction of Chimera Investment CIM appears strongly Bullish.

When running Chimera Investment price analysis, check to measure Chimera Investment’s market volatility, profitability, liquidity, solvency, efficiency, growth potential, financial leverage, and other vital indicators. We have many different tools that can be utilized to determine how healthy Chimera Investment is operating at the current time. Most of Chimera Investment’s value examination focuses on studying past and present price action to predict the probability of Chimera Investment’s future price movements. You can analyze the entity against its peers and financial market as a whole to determine factors that move Chimera Investment’s price. Additionally, you may evaluate how the addition of Chimera Investment to your portfolios can decrease your overall portfolio volatility. The danger of trading Chimera Investment is mainly related to its market volatility and company specific events.

Provides a general description of the business conducted by this company. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Overall, this stock passed 6/38 due dilligence checks and has weak fundamentals, according to our automated analysis. By creating a free account, you agree to our terms of service. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Since 1988 it has more than doubled the S&P 500 with an average gain of +24.52% per year. These returns cover a period from January 1, 1988 through February 6, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return.

Is CIM a good buy?

Valuation metrics show that Chimera Investment Corporation may be overvalued. Its Value Score of F indicates it would be a bad pick for value investors. The financial health and growth prospects of CIM, demonstrate its potential to underperform the market.